A company’s accounts payable (AP) balance consists of the bills you owe your vendors. It is money that is due from your company but has not yet been paid. It appears on your balance sheet as a current liability.

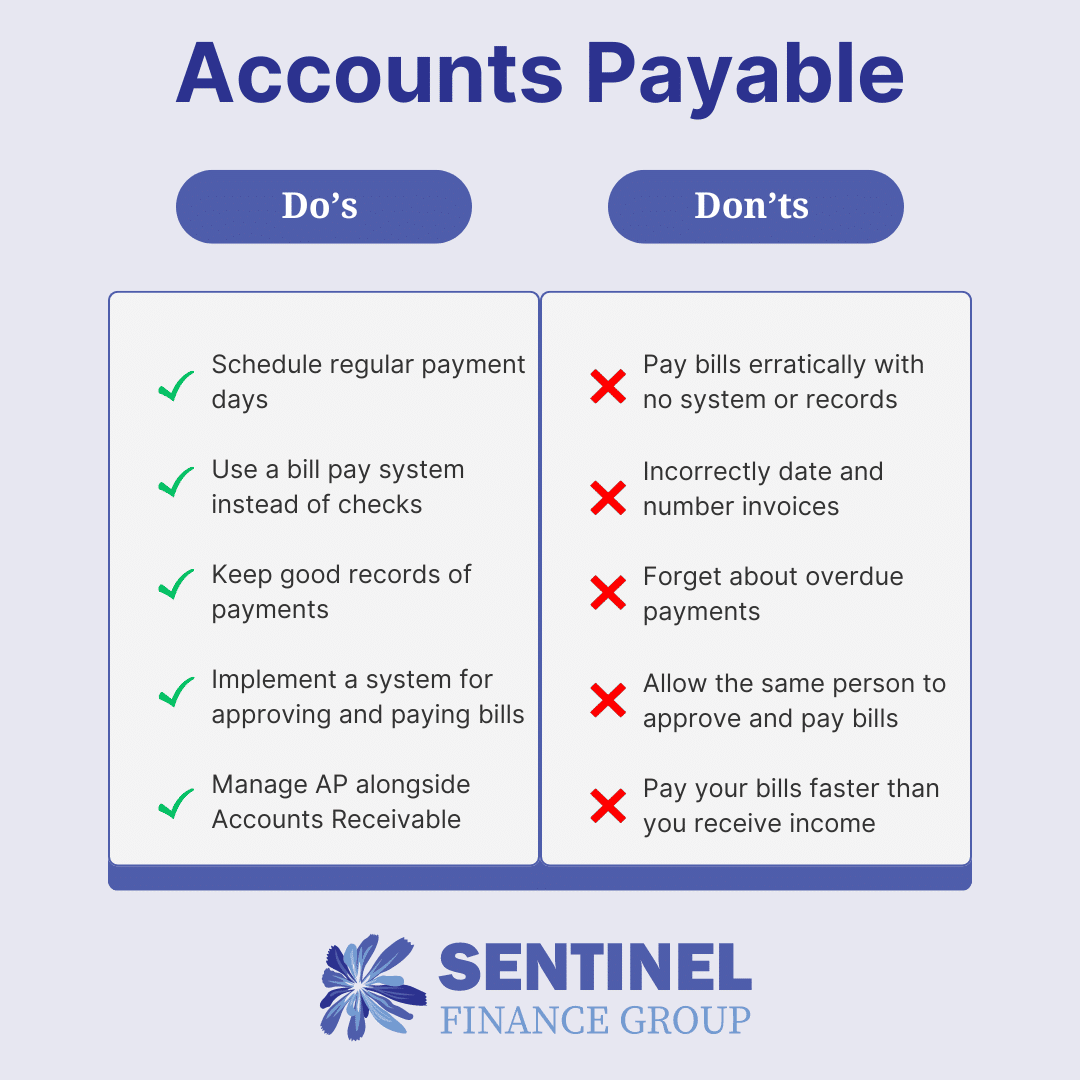

Just as it’s important for a business to have a system for managing AR, it’s also important to have a system for managing AP. You should have regularly scheduled payment days, typically once a week or once every two weeks.

Payment days were called “check runs” in the past, since businesses would literally send checks to their vendors on these days. Some companies still use checks to pay their vendors, but now it’s much more common for a company to pay using ACH or a 3rd party vendor such as Bill.com or Melio. The benefits of using a bill payment system is that you can upload bill documents for record-keeping, and it saves time and money compared to physical mail. It also allows you to have a controlled system for approving and paying bills, which helps prevent fraud.

It’s important to manage AP alongside AR (click here for a refresher on AR). The metric “days in accounts payable” is the average amount of time that a bill remains in your system. Contrary to wanting to collect money you’re owed as quickly as possible, you don’t want to pay your bills as fast as possible. You should pay in a timely manner such that your vendors don’t get upset, but it’s important to balance that with paying at a slow enough rate so you don’t run out of cash. In general, you want “days in AP” to be greater than “days in AR” (which means you bring in money faster than you pay bills).

It’s common for mistakes to occur when Accounts Payable is not managed properly. Typical mistakes we see businesses make are either clerical errors or incorrectly dating and numbering invoices, which can require cleanup later on.

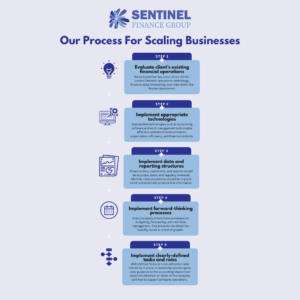

Sentinel Finance Group can help your company manage AP. We can help you regulate how quickly you pay, review your payment process, implement bill pay technology, and prevent fraud by implementing financial controls. We also include “days in AP” and “days in AR” in our financial reporting packages and regularly review them with you.

Sentinel Finance Group is an outsourced CFO firm in Kansas City and provides fractional CFO services and controller services to local businesses.