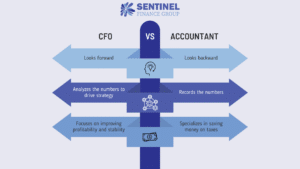

Every CFO should be able to serve in both good and challenging business times. During both times, the CFO role should be to keep a long-term perspective and recommend appropriate actions. With good financial leadership, it’s possible for a company to expand during both good and bad times.

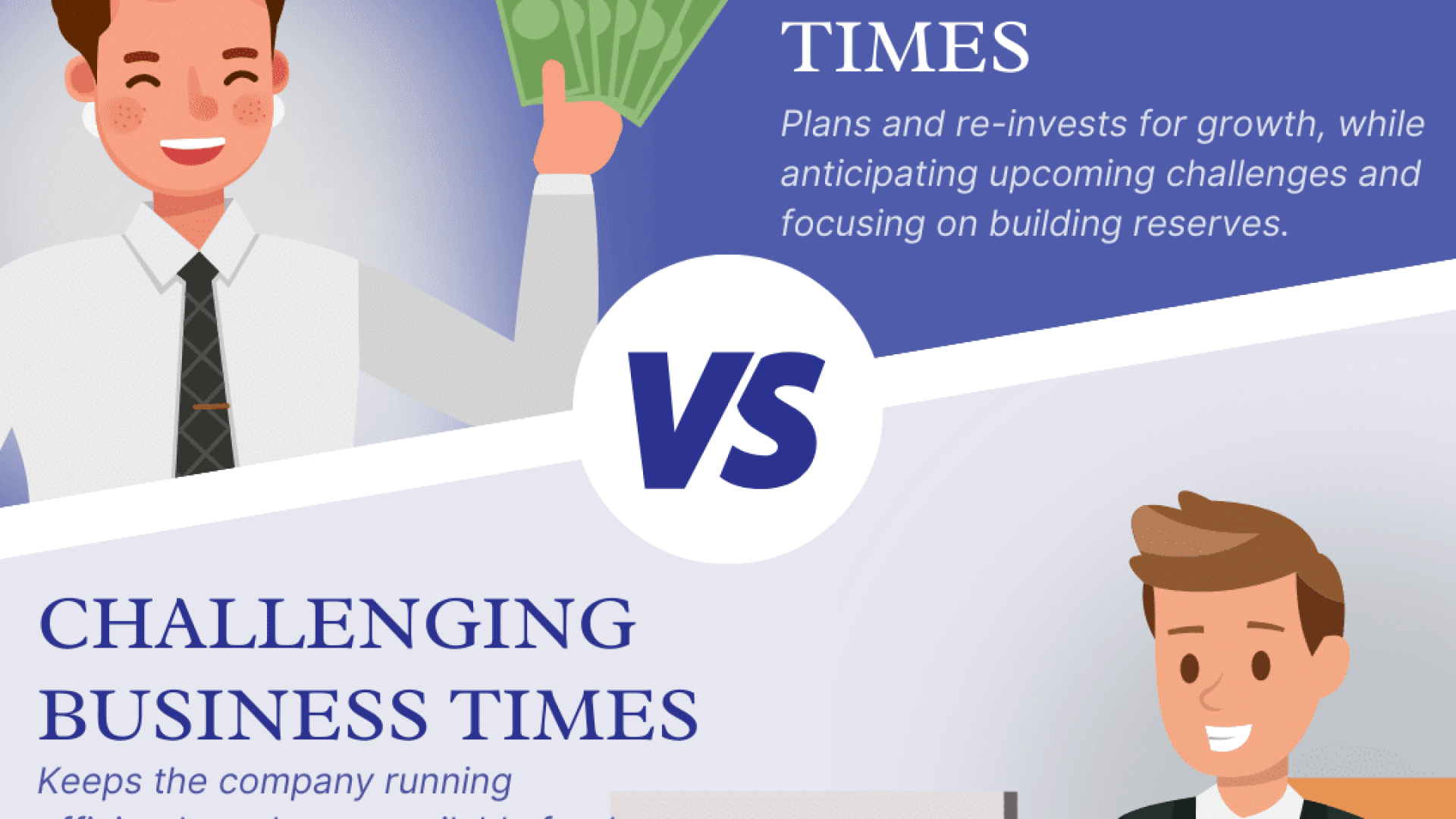

Good times for a business would be periods when a company is growing and expanding, the economy is booming, and/or the business’s product market is doing well. During this time, a CFO should be planning further growth that sets the business up well for the future. It may be a good time to re-invest in the company through acquisitions, expansion, or staffing. A CFO should ensure the company is still running efficiently especially while it is growing to ensure it can still perform well when the business experiences a challenge. Most importantly, a CFO should be anticipating upcoming changes and challenges and focusing on saving cash and building reserves. For example, when PPP funding came along, a good CFO should have advised clients to pay down debt and build reserves, not just give it all out as bonuses.

Challenging times for a business usually means there’s an economic recession, or the company is struggling internally for some reason. A major client leaves, management changes, or there is an unanticipated shift in the market or product technology. During this time, a CFO needs to be a good leader who keeps morale high and has a play to win mentality. A CFO should keep the company running efficiently, and use austerity measures when required. He or she should also have a plan for available funds and reserves to expand the company. During economic challenges, everything is generally cheaper, and competitors are generally either going under or shrinking. If the company was building reserves during the good times, challenging economic conditions can be the best time to make huge gains and expand a company.

It’s important to have an effective CFO during good times, to ensure the company is growing efficiently and appropriately preparing for bad times. During bad times, it’s important to have an effective CFO who can execute the plan that was made during the good times and can quickly adapt to any unexpected challenges. During both good and bad times, a company can maintain stability and grow if it is focused on the fundamentals of cash flow reporting, regular financial oversight and reporting, and reviewing revenue and expenses.

Sentinel Finance Group is an outsourced CFO firm in Kansas City and provides fractional CFO services and controller services to local businesses.