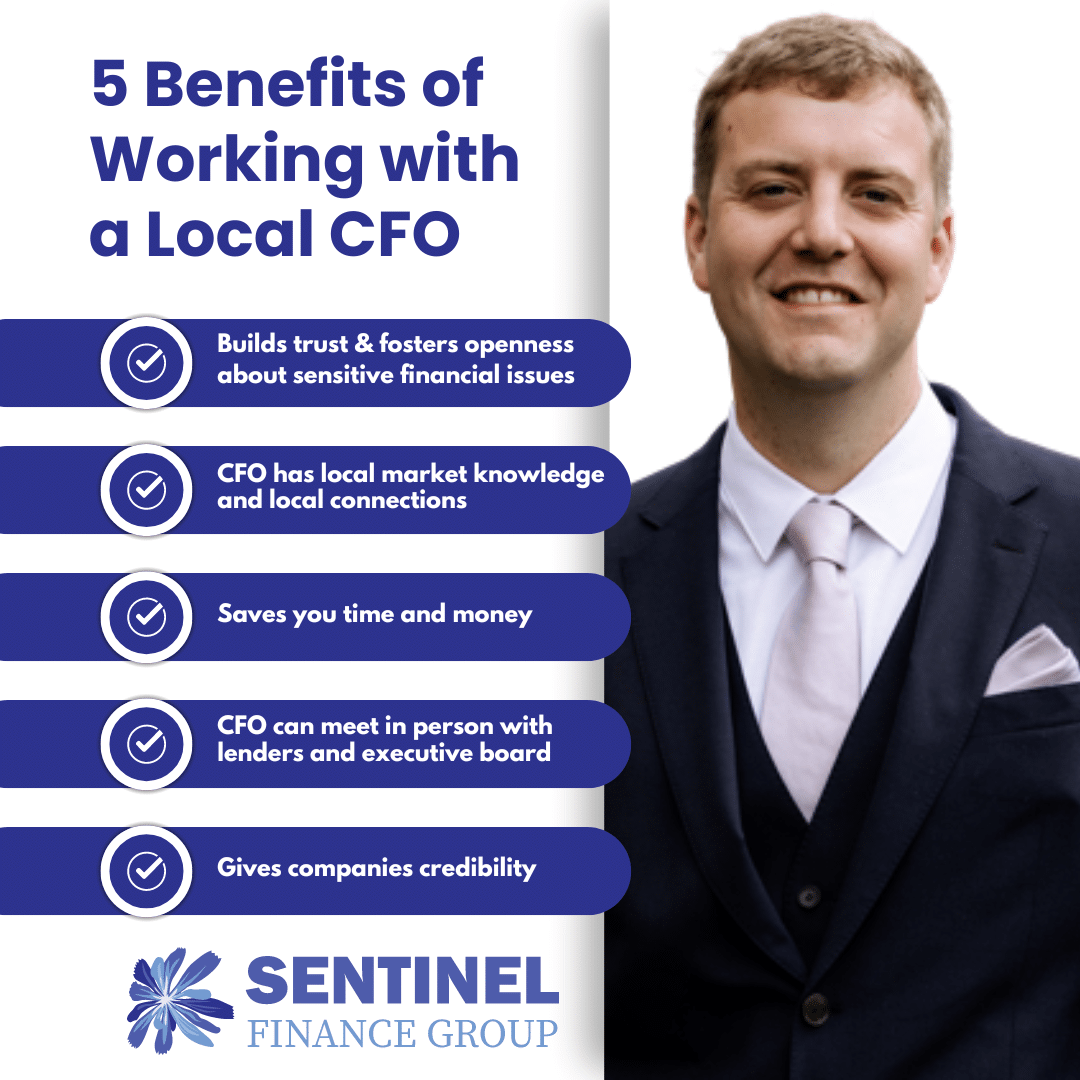

While it’s true that most finance work can be done remotely, there are still benefits to working with a local fractional CFO. My best client relationships have been ones where I can meet with them in person when needed, because it builds trust and fosters openness about sensitive financial issues.

A CFO who is local to your area also comes with local market knowledge and local connections. I regularly attend local business events, meetings, startup events, and panel discussions, which allows me to keep up with local businesses and trends. Local fractional CFOs build relationships with bankers, lenders, and investors, and can utilize those connections to help their clients get funding or find acquisitions.

Working with a local CFO can save you time and money. CFOs become familiar with local lenders’ requirements, and can save time and money by preparing your financials appropriately in advance. It’s also easier and more efficient to communicate in person if a business owner and CFO need to discuss sensitive issues, demonstrate how to do something, or work through a detailed issue.

Having a local CFO can also give companies additional credibility and professionalism, since he or she can physically meet with a lender or investor or present during board meetings. For companies’ most important meetings, holding them in person fosters engagement and encourages ownership of business issues.

In a world where everything is being outsourced, Sentinel Finance Group still values staying engaged in the community and meeting with clients in person.

Sentinel Finance Group is an outsourced CFO firm in Kansas City and provides fractional CFO services and controller services to local businesses.