Many business owners want to know the value of their business. A common misconception is that business value is based solely on revenue, and business owners often tend to get fixated on revenue growth. However, there’s more that goes into it.

A company’s value is related to productivity of the business assets and operations, and grows with equity that has been retained in the business. Investors and lenders will look heavily at the balance sheet, not just profit and loss statements. Of course, generating profit is important, and business owners should be growing revenue and controlling expenses. But a better indicator of business value and wealth lies in the profit retained. You want the balance sheet to show equity–that your business has cash and assets in excess of debt and liabilities.

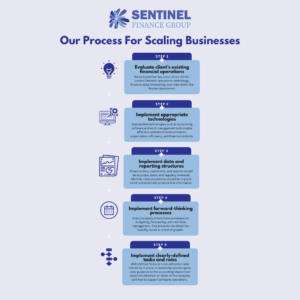

Many business owners fall into the trap of trying to grow their business as quickly as possible. In general, as businesses expand, they become less efficient because they grow more quickly than good systems can be created and maintained. It’s important to take time to build structures, review profitability, evaluate costs, hire the right employees, and obtain the right equipment. Many companies grow too fast, sacrifice profit, and then go out of business because they can’t pay their loans. Other companies grow quickly by seeking outside investors, and founders end up giving all their equity and profit away. Most businesses should focus on growing steadily and efficiently rather than seeking growth at any cost.

Of course, business owners should take advantage of big opportunities as they come. But the best way to be positioned to do this is by maintaining equity and a strong balance sheet. If a true growth opportunity comes, such as developing a new product or expanding into another market, banks and investors won’t lend to a company that doesn’t have a strong balance sheet.

Ultimately, a healthy balance sheet showing strong equity leads to a higher business valuation, more investments, and a higher payout or profit to the owner. Business owners should keep a long-term mindset instead of focusing purely on short-term growth which can ultimately lead to business stagnation.

Sentinel Finance Group helps its clients create and maintain an accurate balance sheet, and we regularly review important KPIs to ensure they are trending in the right direction and that the value of the business is increasing.

Sentinel Finance Group is an outsourced CFO firm in Kansas City and provides fractional CFO services and controller services to local businesses.