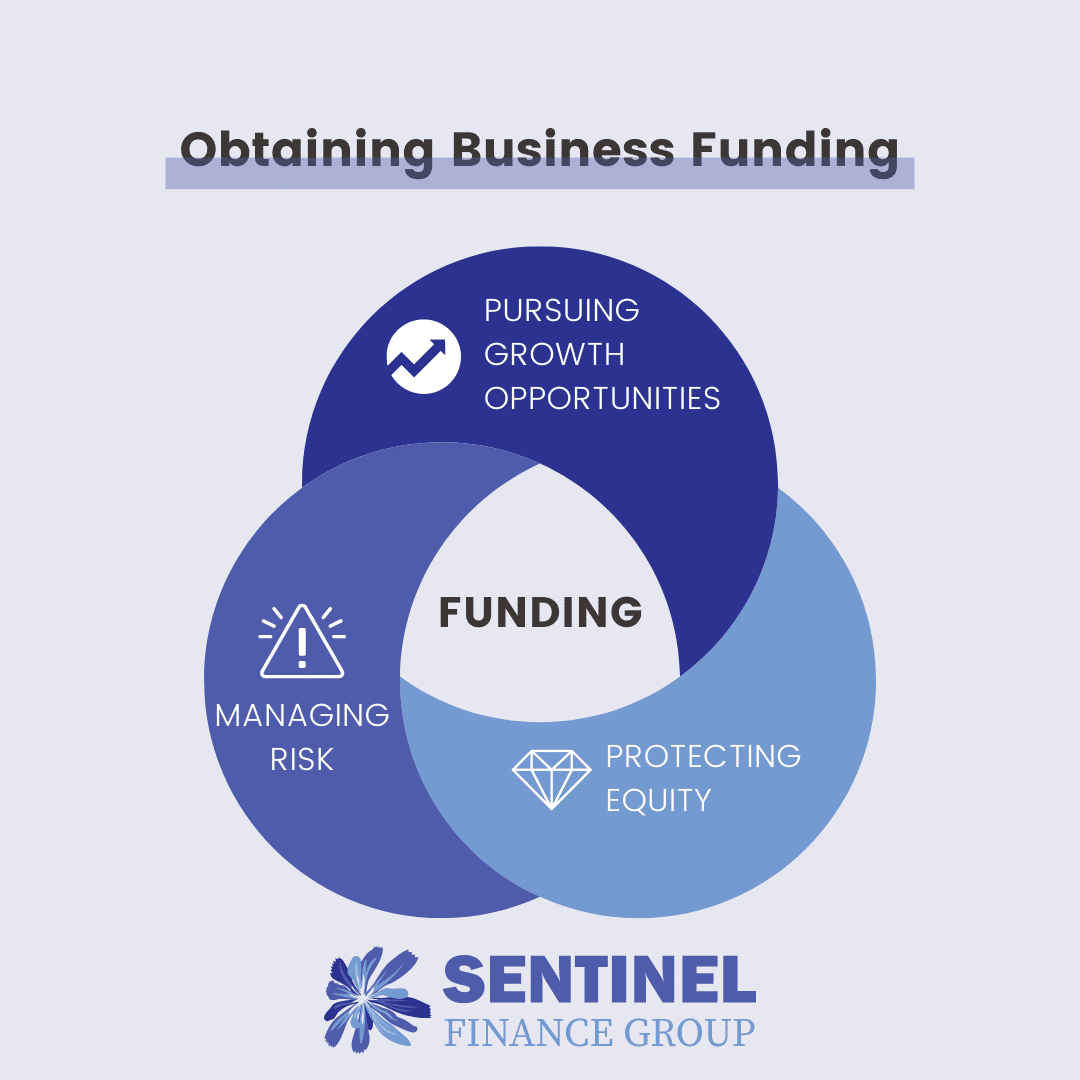

Different funding sources are available to businesses, but some require equity in return for capital. It’s important to consider the balance between taking advantage of growth opportunities and protecting your equity.

It’s very important to consider a couple things when considering selling equity. It can be tempting to sell what seems like a small amount of equity in return for capital. However, once you give away that equity, you can’t easily get it back unless the investor is willing to sell. Additionally, you owe equity partners a financial statement and an opportunity to discuss it. Equity partners have a voice and you’re not just making all your business decisions on your own anymore. So, given these caveats, how do you know when it’s the right time to sell equity?

First, you should only sell equity to partners who you want to work with moving forward and who bring value. They should be strong financial partners, and your character and business values should be aligned.

Second, you should make sure the benefit of selling your equity is in excess of the future payments you will send to the investors. Consider a situation where an investor gives you a small amount of money right now, and all you do is pay off business debt and grow your business by a small amount. If your business survives another 20 years, they may make a huge portion of the profits, which may not have been a great investment for you. On the other hand, consider a situation where you plan to invest in machinery that will take your business to a whole new level. If your annual revenue grows by a factor of 10, even if you split your profits 50/50, you’re still generating significantly more wealth for yourself than you could have otherwise. Generally speaking, if the investment catapults your business to new levels, it may be worth selling some amount of your equity.

Finally, you should consider when the timing is right. You only have so much equity to sell. Once you sell more than 50% of your equity, you’re a minority partner. It’s important not to give away your equity too soon, because the offers and opportunities will be bigger once your company is more successful.

Sentinel Finance Group helps our clients with ROI calculations and evaluating proposals from investors to determine if they are fair and beneficial offers. Sentinel Finance Group also has a mergers and acquisitions branch that helps businesses evaluate and perform financial due diligence when selling their business or acquiring other companies.

Sentinel Finance Group is an outsourced CFO firm in Kansas City and provides fractional CFO services and controller services to local businesses.