The year-end close is the process in which finance and accounting teams finalize and close a company’s books, making any adjustments to ensure the year’s financials are accurate and ready for tax filing. It includes verifying that the profit & loss statement and balance sheet are correct, reviewing accounts receivable and accounts payable, creating year-end reports, and planning for the upcoming year.

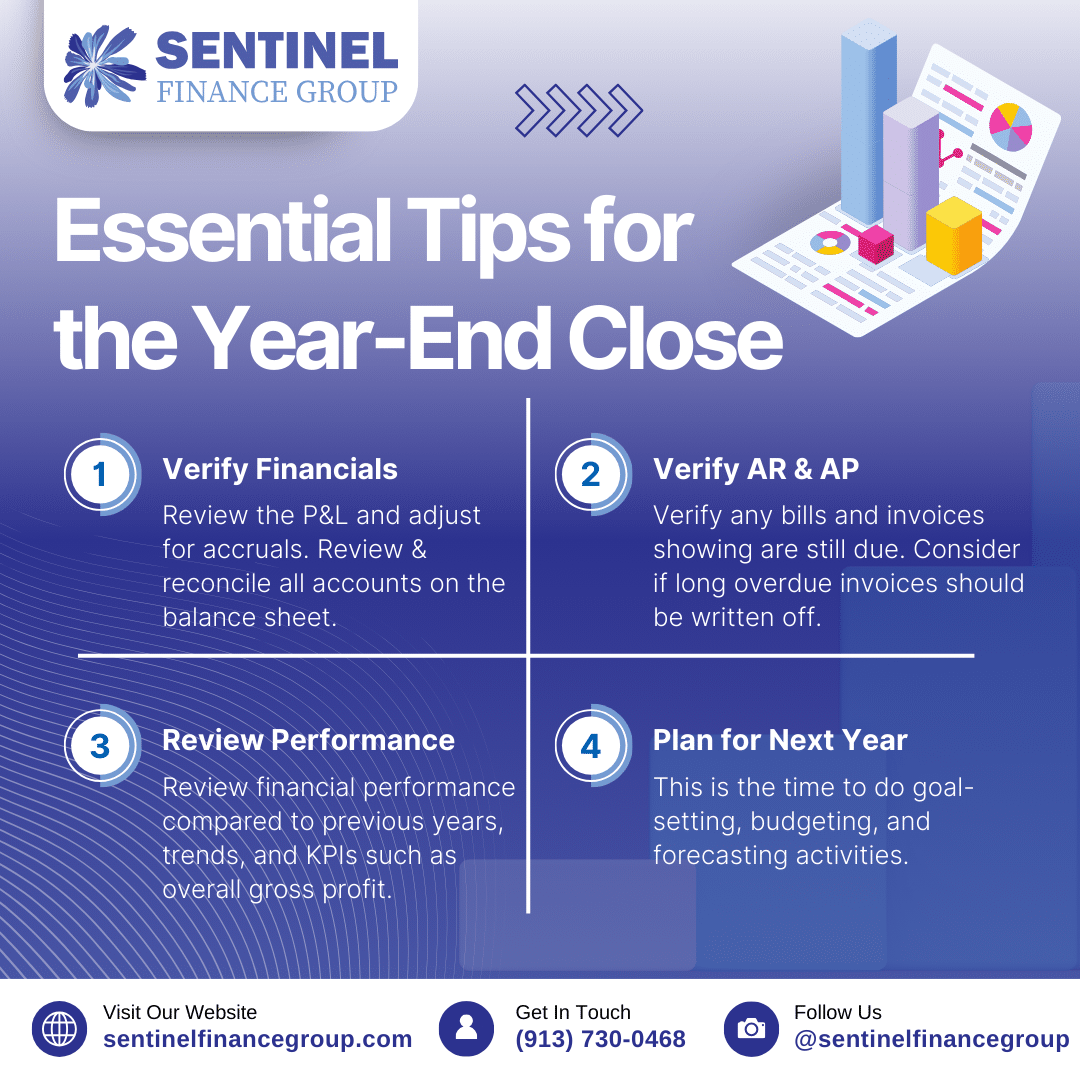

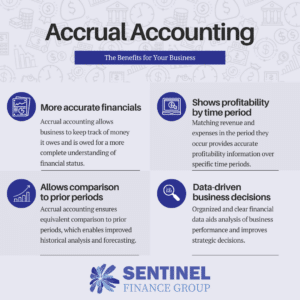

During the year-end close, the profit and loss should be verified for accuracy and adjusted for any accruals. All accounts on the balance sheet should be reconciled and the ending balances should match a third party statement (such as a bank statement).

Accounts receivable and accounts payable should be verified for accuracy, such that the bills and invoices showing are still due. It’s also the time to consider if any long overdue invoices can be collected or if they should be written off.

Year-end is the time to review company performance, including comparisons to previous years, strengths and weaknesses in your business, trends, and KPIs such as overall gross profit. It’s also the time to look ahead and do goal-setting, budgeting, and forecasting activities.

The key to a successful year end is to have a good plan and start it early, ideally before the fiscal year-end. Neglecting to properly complete the year-end close has a few consequences. First, it may cause a business to file its taxes incorrectly and be seen as misrepresenting the business financials. Second, the balance sheet is a financial statement that carries forward, so it becomes more complex to correct the longer a business puts it off. Unclear balance sheets are also opportunities for hiding fraud. Finally, inaccurate financials lead to a lack of understanding of business performance and inaccurate business valuations.

Sentinel Finance Group leads the year-end close process for our clients. We ensure the financials are accurate from an accounting perspective, and we provide expertise regarding decisions such as when to book certain expenses or revenue and when and how to write off balances. Sentinel Finance Group creates the year-end reporting and reviews the financial metrics, KPIs, and trends with our clients’ leadership teams. Finally, we lead the planning, forecasting, and budgeting for the upcoming year.

Sentinel Finance Group is a fractional CFO firm in Kansas City and provides outsourced CFO services and controller services to local businesses.