The signs of an ineffective financial department are clear: confusing or incorrect financials, a lack of useful reporting, missed bills and invoices, or rejected loan applications. The business owner can’t make good strategic decisions due to a lack of clear financial data, and the ineffective finance department prevents company growth. Sentinel Finance Group understands what makes a financial department run successfully, and we utilize a proven process to ensure our clients operate according to this ideal financial model.

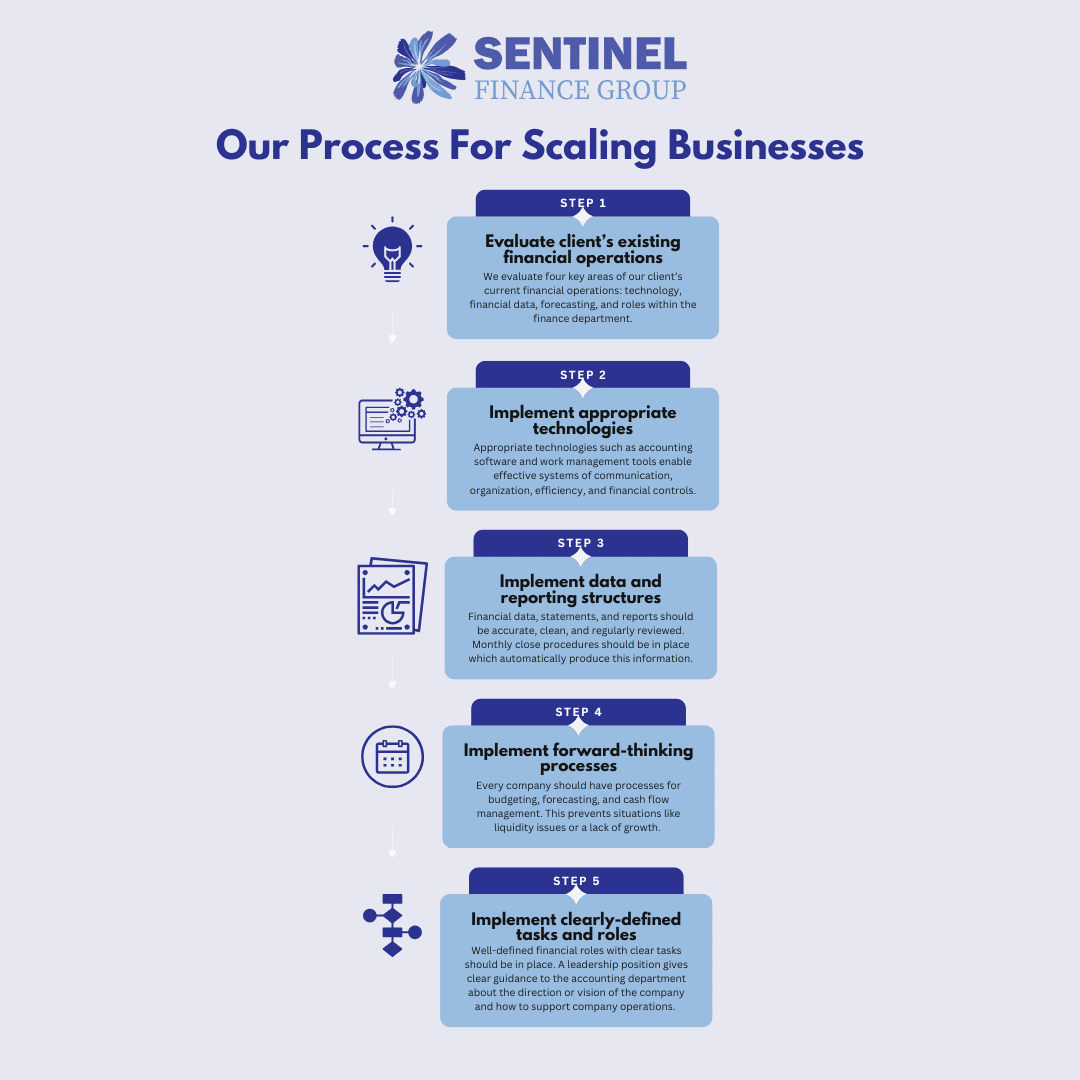

We evaluate four key areas of our client’s current financial operations: technology, financial data, forecasting, and roles within the finance department. Then, we bring CFO leadership to implement procedures and systems which create and maintain a highly effective financial department. This ensures the business runs smoothly, and the finance department has a scalable structure in place which will allow the business to grow.

First, we ensure the finance department utilizes appropriate technologies such as accounting software and work management tools. This sets up effective systems of communication, organization, efficiency, and financial controls.

Second, we assess the company’s existing financial data and reporting. A company should have financial data, statements, and reports that are accurate, clean, and regularly reviewed. An accounting department should have monthly close procedures in place which automatically produce this financial information on a regular basis, without any manual follow up required.

Then, we ensure the finance department has forward-thinking processes that anticipate and plan appropriate responses for market and company changes. Every company should have processes for budgeting, forecasting, and cash flow management. This prevents situations like liquidity issues or a lack of growth.

Finally, we assess the existing roles within the finance department. Well-defined financial roles with clear tasks should be in place. A leadership position (such as a CFO) gives clear guidance to the accounting department about the direction or vision of the company and how to support company operations. Under CFO leadership, a company may have roles based on the specific needs of the business, such as a controller, staff level accountant, bookkeeper, etc.

The end result of Sentinel Finance Group’s process is a highly effective financial department that produces accurate and useful information which is used to make forward-thinking decisions and grow the business.

Sentinel Finance Group is an outsourced CFO firm in Kansas City and provides fractional CFO services and controller services to local businesses.