Businesses have the option of using the cash or accrual method of accounting. Cash accounting recognizes revenue and expenses at the time the cash is received or paid. Accrual accounting records revenue when earned (regardless of when the revenue is received) and expenses when incurred (regardless of when the expenses are paid).

In cash accounting, if a company sends a check for January rent at the end of January, and the check doesn’t get deposited until February, it would be recorded as a February expense. In accrual accounting, this same event would be recorded as a January expense. It works the same on the revenue side as well. In cash accounting, if a company leases out office space, and the customer pays for January rent two months late, the company would record the payment in March. In accrual accounting, the leasing company would date the invoice in January and apply the payment to that invoice.

Cash accounting is simpler to understand and implement, so many business owners opt for this method in the beginning, especially if they run the books themselves. And for businesses where most of the revenue is received when it’s earned (such as restaurants or convenience stores), cash accounting is sufficient. However, most companies (especially companies that are trying to grow) should use accrual accounting due to a few major benefits.

Accrual accounting accurately shows profitability by time period. For example, a construction company may have a project that is completed during May and June, but materials were purchased in April and the customer pays in August. To accurately understand the company’s profitability during the project timeline, it would be important to ensure the costs of materials and labor match the period when the invoice is sent to the client. At the same time, this company may have ten different construction projects going, each with different timelines of revenue and expenses. The only way a company running on cash basis could accurately understand profitability over a given timeline is if someone organizes all of the matching revenue and expenses in a spreadsheet, essentially doing the accrual accounting work. Some companies do this, but it would be much faster and more accurate to simply run their accounting in accrual. For companies that have various revenues and expenses occurring across many projects and timelines, accrual accounting is essential.

Accrual accounting leads to more accurate financial reporting overall. Accrual accounting not only organizes financial data and shows profitability within time periods, but it also allows apples to apples comparison to prior periods, which allows for improved historical analysis, budgeting, and forecasting. Accrual accounting also allows businesses to keep track of money it owes others (accounts payable) and money it is owed by others (accounts receivable), which gives a more complete understanding of a business’ financial status at any given time. Overall, accrual accounting creates a more accurate picture of finances and business performance, which allows more informed business decisions.

A business can switch to accrual accounting at any time, even if it continues to file taxes on cash basis. Many businesses run their internal books on accrual accounting and file their taxes on cash basis (businesses should consult a CPA to understand which method is more beneficial from a tax perspective). When switching from cash to accrual, we recommend assistance from an accounting professional because accrual accounting requires double-entry accounting. The accounting method affects a company’s profit and loss statement because it determines the time period when revenue and expenses are recognized. It also affects the balance sheet because accrual accounting requires additional balance sheet accounts such as accounts receivable, accounts payable, prepaid expenses, accrued expenses, and accrued liabilities.

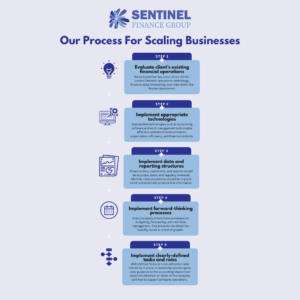

Sentinel Finance Group can lead the transition from cash to accrual accounting by implementing systems of invoicing and billing. We use accrual accounting in our financial reporting to provide our clients with accurate information about profitability within time periods in order to better analyze historical trends and make strategic decisions about the future.

Sentinel Finance Group is a fractional CFO firm in Kansas City and provides outsourced CFO services and controller services to local businesses.