I’m often asked, “Why does my business need a CFO?”

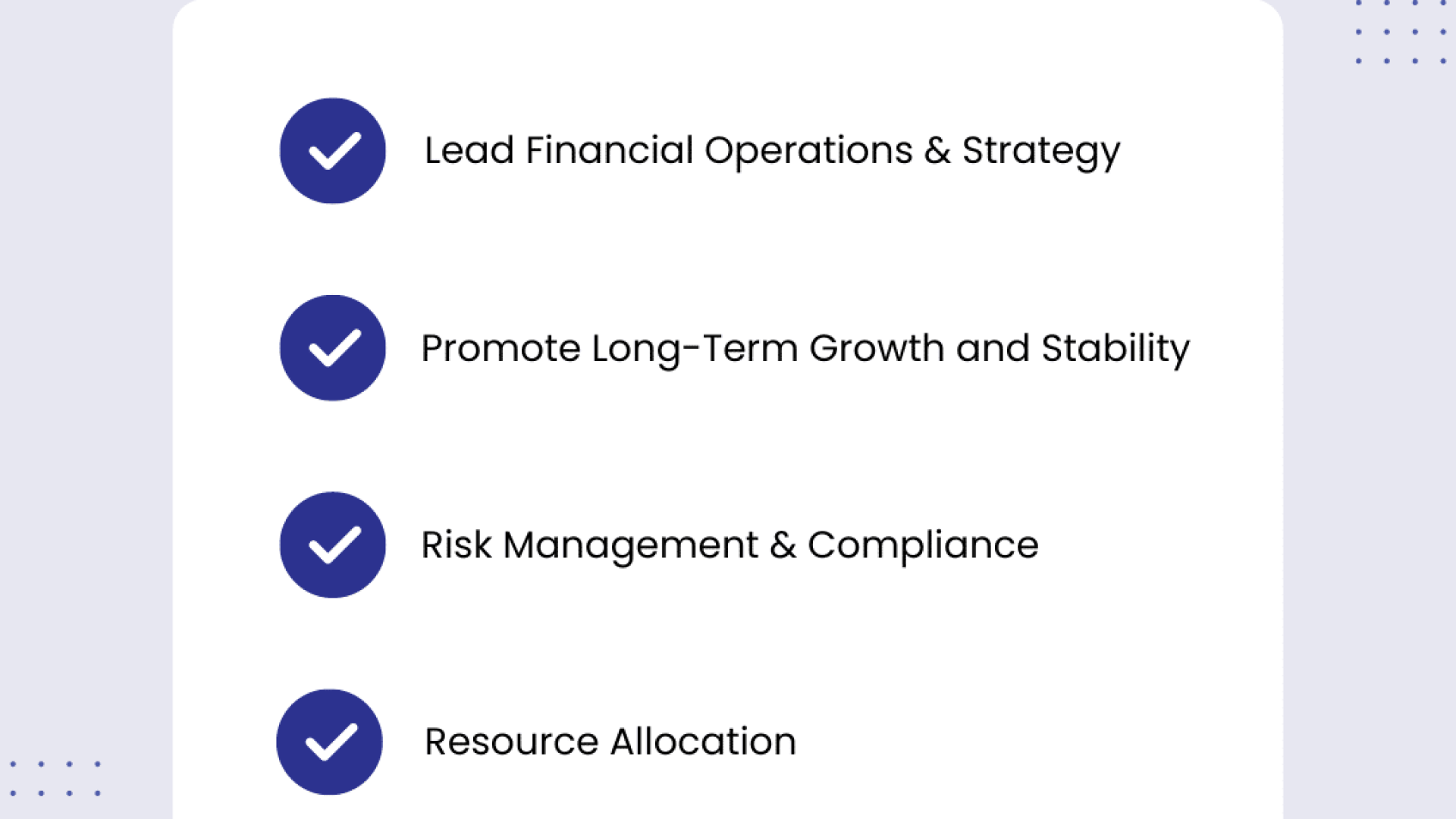

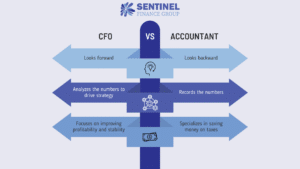

A CFO is your top financial expert who leads the finance and accounting departments. This is different from any other accounting or finance role because it is forward-thinking instead of reactive. A CFO leads the financial operations and strategy, manages risk and compliance, promotes long-term growth and stability, and recommends how to best allocate a company’s resources. They are valued because they advise a company how to grow further and plan for the future. During times with economic downturns or internal business challenges, a CFO is needed to help a company weather the storm and remain profitable.

What many business owners don’t realize is that the CFO role is also critical for startups and small businesses. He or she provides accounting oversight and direction to ensure systems are set up correctly from the start. This allows for efficient growth and ensures a company avoids financial mistakes that may cost lots of time and money to fix down the road. A CFO makes sure a business is healthy, by considering a company’s expenses, profitability, and debt levels.

You can read more about the CFO and accounting services we provide here.

Sentinel Finance Group is an outsourced CFO firm in Kansas City and provides fractional CFO services and controller services to local businesses.