I always tell my clients that they should have a minimum of 10% average profit for the year, and they should be shooting for 15%.

This might come as a shock to many business owners, who consistently maintain low profit margins of 2-5%.

The main reason that 10% profits are important is because a company survives by its profits. Profit is what allows a company to grow, and also to make it through downturns or internal business challenges. Growing revenue does not mean a company is growing (if your expenses increase at the same rate as your revenue, your company will be stagnant).

Over the long term, low profit margins restrict a company’s ability to do vital things like build cash reserves, invest in new capital, acquire other businesses, and invest in employees. These activities are needed to survive and grow over the long-term.

Profit is also important because it’s an easy and effective way for business owners to understand if their business is doing well. It helps a business owner understand how much wealth they have in their business, because profit and equity go hand in hand. Equity is essentially accumulated profits, and you want your equity to be growing over time. It’s the key metric that banks and investors will look at when deciding whether to invest in and grant loans to your company.

Business owners must remain disciplined about maintaining 10-15% profits, otherwise they will never consistently hit it. This means it’s something you need to be monitoring every month and reacting appropriately if your business isn’t hitting it. If you’re not hitting 10% profits, something is wrong and a change needs to be made. You may need to assess whether you need to increase revenue, manage the costs of projects, lower operating expenses, or pay down debts if loan interest is eating up the profits.

It’s important to note that this is 10% profit AFTER business owners pay themselves and employees reasonable salaries. If you claim you made 10% profits but didn’t pay yourself a salary as the business owner, you didn’t make 10% profit (however, you can always decide to take out a portion of profit for your personal use as an owner’s draw in addition to your salary).

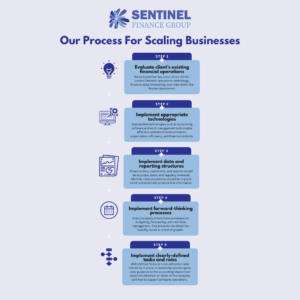

Sentinel Finance Group helps our clients regularly monitor profit levels and makes recommendations on how to increase them to 10-15%.

Sentinel Finance Group is an outsourced CFO firm in Kansas City and provides fractional CFO services and controller services to local businesses.