The balance sheet is one of the three main financial statements you need for your business (the other two are the profit and loss statement and statement of cash flows). The balance sheet is often neglected by business owners because they don’t understand the importance. They instead focus on the P&L because they are mostly concerned with profit in a given time period. However, the balance sheet is just as important (if not more important) because it tells you the financial health and long-term financial position of your business. It’s vital if you want to know how much your business is worth, or if you’d like money from investors or banks, who will use the balance sheet to understand your business performance.

The balance sheet shows a business’ total assets, liabilities, and equity. Unlike the P&L or statement of cash flows which cover a specific time period, the balance sheet carries forward from the inception of your business and acts as a total financial snapshot at a given point in time.

Some of the most important indicators on a balance sheet are short-term liquidity and equity. The short-term liquidity indicates how easily a business is able to repay its short-term debt with its short term assets (or how likely the business is to stay afloat). Equity shows the value of the business (what’s left if you sell all your assets and pay off all debts).

In addition to short-term liquidity and equity, a balance sheet shows the long-term liquidity and profitability of a business, how much the business has paid out to investors, and how much cash a business has.

The balance sheet is often neglected and not reviewed by a professional accountant, which leads to neglected accounts and misrepresented financial data. This means you could make bad internal business decisions, or could get in legal trouble if you obtain loans, investments, or grants.

Business owners often procrastinate fixing their balance sheets, but the longer they wait, the more complex and expensive it becomes. However, there are often practical approaches to clean it up instead of going the extremely detailed and expensive route.

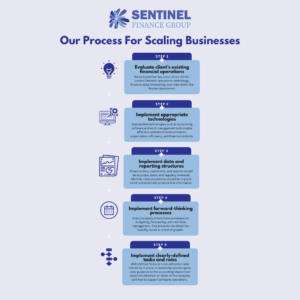

Sentinel Finance Group can review your balance sheet and help you make sure it is accurate, use it to create strategic reporting, and present it to outside entities and for internal reporting.

Sentinel Finance Group is an outsourced CFO firm in Kansas City and provides fractional CFO services and controller services to local businesses.