The profit & loss statement (P&L) is one of the three main financial statements (the other two are the balance sheet and the statement of cash flows). The goal of the P&L is to measure a company’s financial performance and profit. Profit is how a company builds equity, which is what drives company growth and owners’ wealth.

The P&L captures a specific time period of financial data (such as the current month, quarter, or year). It shows a company’s revenue, cost of goods sold, expenses, and any other accounting activity such as interest expenses, amortization, and depreciation. At the very top, a P&L will show revenue followed by cost of goods sold (COGS). Subtracting those two numbers equals gross profit, which is then followed by a list of expenses. Subtracting expenses from gross profit shows the operating income or loss. That is followed by other expenses such as interest, depreciation, amortization, etc. The net of all that is a company’s profit or net income/loss (the bottom line).

Operating income is a good place to measure the profitability of a business as a whole, whereas net profit can skew the picture by including a lot of other things such as interest on loans, write-offs, etc.

The P&L can demonstrate changes between periods, such as monthly or annual changes in revenue. It can show where tweaks can be made to cut costs or be more efficient. The information is also used in forecasts to make sure companies have enough revenue coming in to pay expenses.

The P&L relates to the balance sheet because the P&L is what calculates and shows the details for the net income number, which goes into the equity section of the balance sheet.

I often see companies make various mistakes on their P&L. For example, as companies have different people working on their finances over time, more and more accounts get added to the P&L. This ends up showing too much information and making the data difficult to interpret. P&Ls really shouldn’t exceed a page (a more detailed level can be handled in accounting systems). Another issue I see is that companies will record revenues and expenses incorrectly according to accrual accounting. This makes it impossible to compare periods accurately because costs and revenue are not being allocated at the time of the service. Another mistake is mixing up COGS and expenses, which makes gross profit information inaccurate. It’s important to be accurate because a company’s decisions will only be as good as its data.

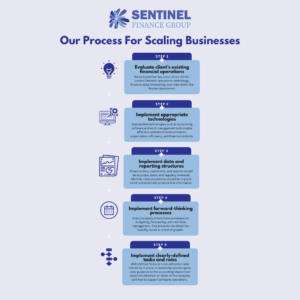

Sentinel Finance Group ensures clients have clear P&L statements, which often includes simplifying the chart of accounts to ensure the information shown is meaningful. We provide regular P&L reporting where we present profitability, revenue, costs, and KPIs to our clients so they understand how their business is performing in certain periods and where improvements can be made. We present P&Ls in a professional manner to financial institutions and investors, ensuring they are accurate and professional. Finally, we help companies with P&L clean up, such as accurately matching costs to revenues in accrual systems.

Sentinel Finance Group is an outsourced CFO firm in Kansas City and provides fractional CFO services and controller services to local businesses.