Financial controls are systems a company sets up to ensure the accuracy of its finances. Financial controls can prevent financial errors, fraud, and inefficiencies. Small businesses often lack proper financial controls, which can result in disorganization, financial losses, and decreased profitability.

Here are some examples of financial controls that all businesses should have in place:

-

- Separation of duties. This limits the ability of any one person to make errors or commit fraud. For example, to prevent fraud, a company may have one person responsible for accounts payable and printing checks and another person responsible for signing the checks. Separation of duties also helps hold everyone accountable and increases efficiency. For example, a company may decide to have multiple people responsible for the accounts receivable activities. One person could be responsible for sending invoices, another for collections, and another for collections past due 60 days. Sentinel Finance Group reviews our clients’ financial departments to ensure adequate separation of duties.

-

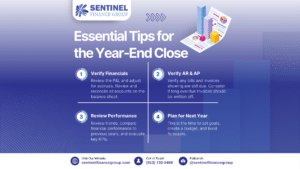

- Financial oversight and auditing. It’s important to hold 3rd party reviews of financial work done by employees and contractors to ensure accuracy and mitigate risk. Sentinel Finance Group does this by reviewing our clients’ financials on a monthly basis, not just from a financial performance perspective, but also to ensure everything makes sense from an accounting level perspective.

-

- Budgeting & forecasting. Reviewing actual expenses and revenue against the budget keeps departments accountable and efficient.

-

- Bank reconciliations. The purpose of reconciliations is to ensure all transactions in a company’s accounting systems are based off of activities that actually happened. Reconciliations can prevent activity such as transactions leaving the bank account but not being recorded in the internal accounting system.

-

- Cash management. This includes policies and oversight for handling cash, such as securing petty cash funds or requiring daily bank deposits.

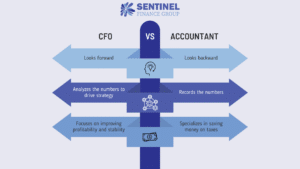

Sentinel Finance Group helps our clients establish financial controls and automate them as much as possible by implementing software such as bill payment systems and approval functions. Sentinel Finance Group also provides CFO and controller level oversight of financial statements to prevent fraud and ensure the accuracy of our clients’ financial systems.

Sentinel Finance Group is an outsourced CFO firm in Kansas City and provides fractional CFO services and controller services to local businesses.