Lately, I have seen many companies experiencing decreasing gross profit and operating profit margins as a result of higher expenses and higher labor costs. Decreasing profit margins results in overall less cash and lower liquidity, which makes it more difficult for businesses to manage their cash flow. Over the long term, lower profit margins will eventually lead to losses, and companies need to stay profitable to stay in operation.

The decreasing profit margins are occurring primarily due to high inflation. Many companies are trying to combat the increasing expenses and increasing employee wages with aggressive revenue growth. They are often seeking large investments to start new revenue lines, but it’s a vicious cycle because it’s harder for companies to get an investment when they are not as profitable or have as much in cash reserves anymore.

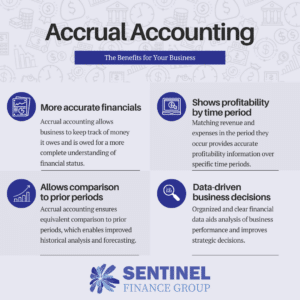

To address these problems, it’s vital for business owners to first have a very clear understanding of their company’s financials. This requires well-organized financials that follow accrual principles (tracking revenue and costs in the periods they are incurred) so one can clearly see gross profit trends. In addition, the chart of accounts needs to be strategically set up to track the different lines of revenue and their associated costs, to make it easier to understand which sectors of a company are performing better or worse. These practices allow companies to make better decisions.

Once a company has a clear understanding of its financial position, it can address the profit margin issue by either increasing revenue, becoming more efficient, or lowering expenses.

To increase revenue, a company could add a product or service. However, it’s important to remember that the revenue increase needs to result in an increased profit margin in order to increase overall profitability. A company should create clear goals and forecasts and define measurable parameters to consistently track. Acquisitions are another viable route to consider during this time, because competitors may be struggling with the same problem and can be acquired more cheaply than previously.

To increase efficiency and reduce COGS, a company may choose to focus on its best sectors or products, renegotiate with vendors, better manage inventory, or automate operations. Again, it’s important to have a solid understanding of your company’s financials and COGS to be able to make a difference here.

A company may become bloated with unnecessary expenses during good times, so now could also be time to evaluate expenses. However, a business should always consider its employees as its most valuable asset–more valuable than machinery or intellectual property. Any labor reduction needs to have a really good reason for it, because rehiring is costly and more difficult since it’s currently a competitive market and labor costs have increased. It’s also important to consider the additional costs of training, lost experience, and loss of internal process knowledge. A business should evaluate every other expense before laying off employees, such as downsizing, moving office spaces, or eliminating unnecessary subscriptions.

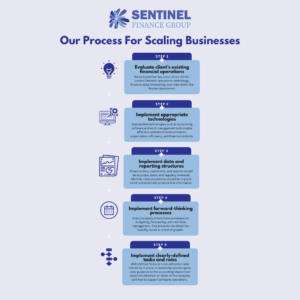

Sentinel Finance Group cleans up our clients’ financials to provide clear and meaningful data. We help analyze and select the best strategies to increase profit margins, and we help implement the strategies by assigning measurable parameters. Sentinel Finance Group also helps our clients complete acquisitions by providing financial due diligence, assessment about the deal profitability and integration, and support in negotiations and deal structuring.

Sentinel Finance Group is a fractional CFO firm in Kansas City and provides outsourced CFO services and controller services to local businesses.