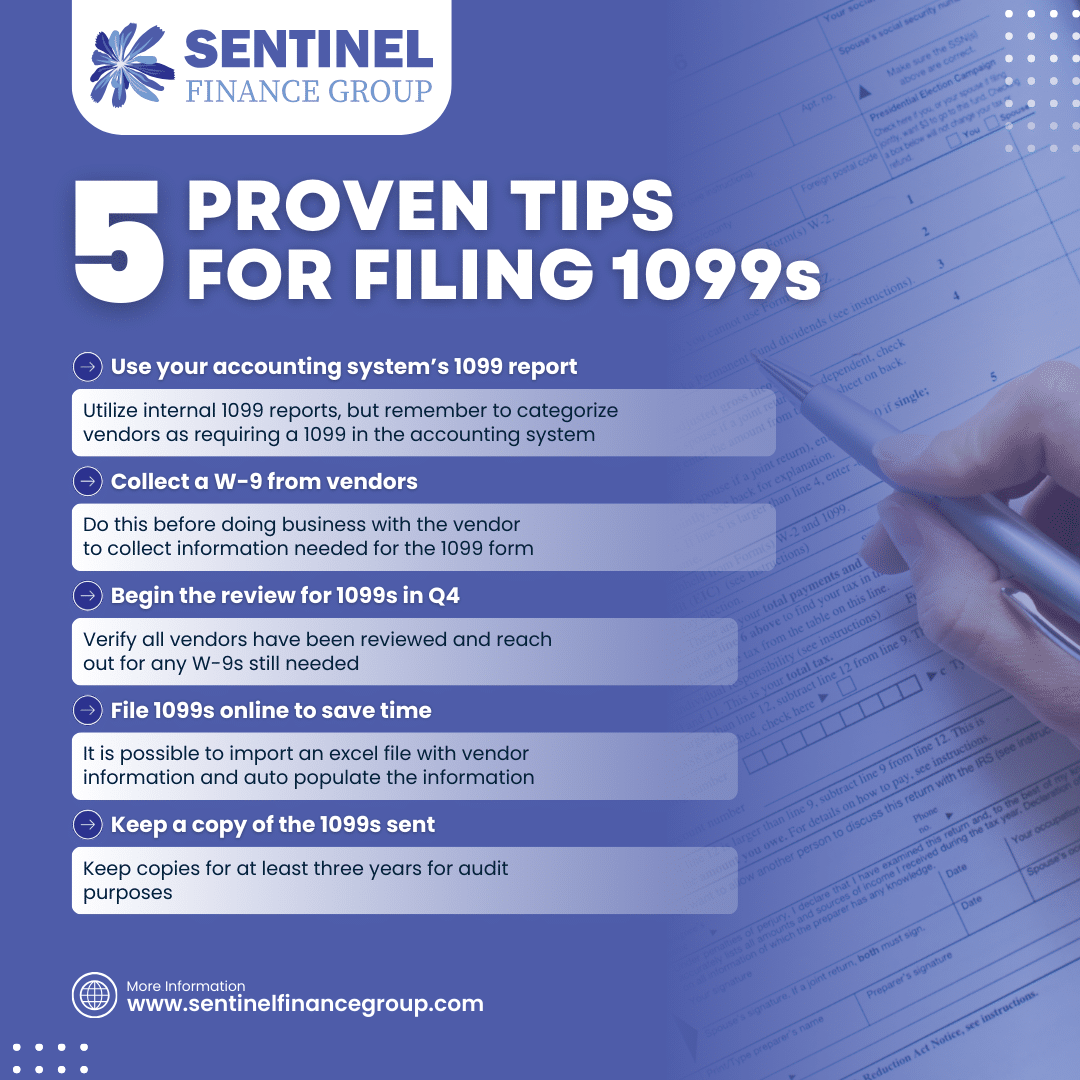

Form 1099-NEC is a tax form that businesses must file by the end of January each year. It reports payments of more than $600 from a business to independent contractors and vendors who are not employees (there are other types of 1099 forms to report other types of payments). A business should send a 1099 to the IRS and to the contractor, and keep a copy for audit purposes. The purpose of the form is to report non-employee payments to the IRS, and so the contractors can complete their taxes.

First, businesses need to review each vendor that they paid in the year to decide whether they should receive a 1099. They should be non-employee taxpayers, but corporations are not included. Second, businesses need to verify whether each payment a vendor received is eligible to include in a 1099. Only service expenses should be included–expense reimbursements should not be included in the 1099 amount. For example, if a business pays a construction contractor for a service and also reimburses them for materials, the material amount would not be included in the 1099.

Most accounting systems have an internal 1099 report. The internal report can be a good tool, but only if the parameters are set up properly and the input is correct. Usually a vendor needs to be categorized as requiring a 1099 in the accounting system, and the general ledger codes the report is pulling from need to be verified.

To fill out a 1099 form, you need information such as a company’s name, address, and a tax ID. A W-9 collects this information from the vendors. Businesses should collect a W-9 from all its vendors, ideally before doing business together.

The preparation for filing 1099 forms should really start by the beginning of Q4, as part of a business’ year end. This review should verify that vendors are assigned to all the expenses and everything is coded correctly in the books. If you don’t have all the vendors’ information, now is the time to ask them to fill out a W9.

Now you can also file 1099s online instead of filling out physical forms. Filling them out online will require an additional fee, but if there’s more than 10-15 to file, it’s likely worth it. You can usually import an excel file (sometimes directly from the accounting system report) and it will auto populate the information. This can save a lot of time and money compared to manually preparing and mailing each individual form.

Sentinel Finance Group leads the process to file our clients’ 1099s and properly identify vendors and general ledger codes.

Sentinel Finance Group is an outsourced CFO firm in Kansas City and provides fractional CFO services and controller services to local businesses.