Funding Sources for Businesses: Bank, VC, Angel, Self-Funded

The four main funding sources for businesses are bank loans, venture capitalists, angel investors, and self-funding. Each comes with pros and cons to consider.

From the CEO

The four main funding sources for businesses are bank loans, venture capitalists, angel investors, and self-funding. Each comes with pros and cons to consider.

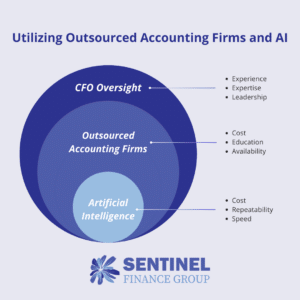

Outsourcing and AI can be good tools to utilize in your business. However, it’s still important to have highly skilled financial oversight for a few reasons.

The profit & loss statement (P&L) is one of the three main financial statements a business needs. The P&L measures a company’s financial performance and profit.

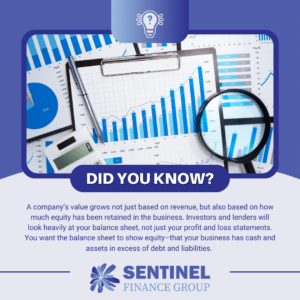

Many business owners want to know how much their business is worth. Many think business value is based solely on revenue, but there’s more that goes into it.

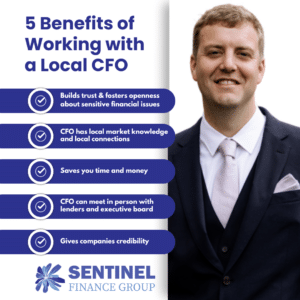

While it’s true that most finance work can be done remotely, working with a local fractional CFO can build trust and foster openness about sensitive issues.

It’s vital for companies to have regular financial meetings with a CFO so important trends in the financial performance can be highlighted and discussed.

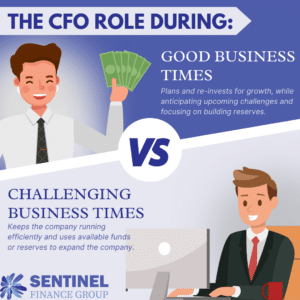

During both good and bad business times, the CFO role should be to keep a long-term perspective and recommend appropriate actions for stability and growth.

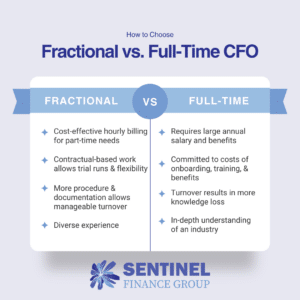

A company is often prompted to find a CFO when their business starts to get more and more complex. But should a company hire a full-time or fractional CFO?

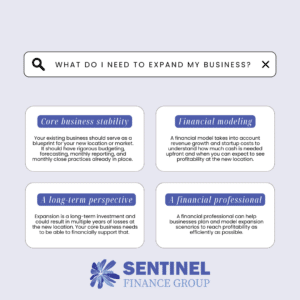

In order to successfully expand your business to a new location or market, it’s important to have a few financial pieces in place first.

info@sentinelfinancegroup.com

+1 (913) 730-0468