Managing Business Growth Without Sacrificing Profitability

Managing business growth is key to remaining profitable. The four key areas of managing growth are sales/revenue, expenses, price, and gross profit.

From the CEO

Managing business growth is key to remaining profitable. The four key areas of managing growth are sales/revenue, expenses, price, and gross profit.

It’s important to be forecasting in addition to budgeting because budgets become less reliable as changes inevitably happen during the year.

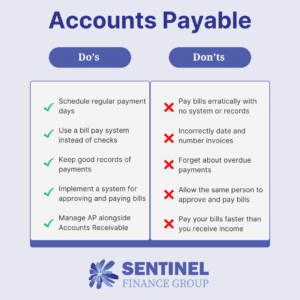

A company’s accounts payable (AP) balance is a liability that consists of the bills you owe your vendors. It’s important to have a system for managing AP.

A company’s accounts receivable (AR) balance consists of invoices that have not yet been paid. A business should have a system for managing and reviewing AR.

A balance sheet tells you the financial health of your business. It’s vital if you want to know how much your business is worth, or if you’d like funding.

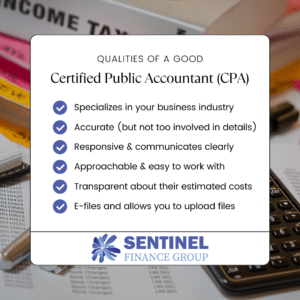

A CPA acts as your financial expert when it comes to filing taxes, and a good one can save you a lot of time and money. How do you know if you have a good CPA?

These days, there are countless accounting software to choose from. How do you know which one to choose for your business?

Without cash, you cannot pay employees or vendors and business operations stop. A cash flow report makes sure your company never runs out of cash.

As a business owner, it’s your responsibility to ensure your financial department is performing effectively and efficiently. Here are some vital qualities.

info@sentinelfinancegroup.com

+1 (913) 730-0468